Liquid Packaging Cartons Market

Global Liquid Packaging Cartons Market Size, Share & Trends Analysis Report, By Carton Type (Brick Cartons, Tetrahedron Cartons, and Gable Top Cartons), By Application (Milk, Juices, Liquid Foods, Energy and Soft Drinks, and Others) and Forecast, 2020-2026

The global liquid packaging cartons market is estimated to grow at a CAGR of 5.0% during the forecast period. Carton packaging is one of the most sustainable packaging solutions, which uses the paper board produced from renewable wood. Its space-saving and lightweight design facilitate filling and transportation of food and beverages. These packs are easy to open, eye-catching, and outfitted with all essential convenience factor. Carton packaging for beverages has been gaining immense popularity owing to their benefits, such as offering product protection and supporting ambient distribution. These cartons are known as aseptic cartons that allows extensive distribution of food products at ambient temperatures while maintaining the safety of the food and beverages and nutritional quality.

Key factors contributing to the growth of the market include a significant increase in food and beverage industry and rising concerns for plastic packaging. Plastic packaging is not fully recyclable, which is detrimental to the environment and human health. In Europe, nearly 25.8 million tons of plastic waste produced every year. Less than 30% of this plastic waste collected for recycling. Rest plastic packaging are highly wasteful and affects the earth’s ecosystem. As a result, most of the food and beverage manufacturers are focusing on achieving maximum sustainability of their packaging by replacing plastics packaging with cartons packaging.

Further, digital cartons provide benefits to the brand and supply chain, such as improved quality in terms of color consistency and reduced defects cycle time. In January 2019, Tetra Pak declared that it would offer new levels of flexibility and customization with digital printing technology. It will become the first company in the food and beverage carton industry that offers full-color digital printing on its carton packages, working in partnership with Koenig & Bauer, which is engaged in this field and based in Germany. With digital printing, beverage brands can explore additional benefits such as the ability to include a range of designs in the same order and dynamic on-package printing. Therefore, the trend towards digital cartons is expected to offer an opportunity for the liquid packaging cartons market.

Market Segmentation

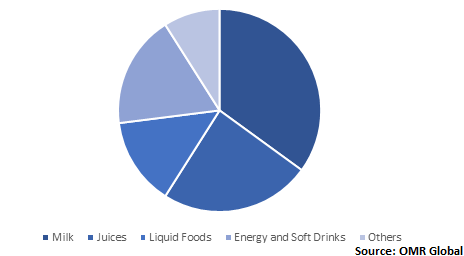

The global liquid packaging cartons market is segmented into carton type and application. Based on the carton type, the market is classified into brick cartons, tetrahedron cartons, and gable top cartons. Based on application, the market is classified into milk, juices, liquid foods, energy and soft drinks, and others.

Liquid Cartons Finds Significant Application in Packaged Milk

Increasing urbanization is leading to increasing consumption of packaged milk. Rising preference for flavored milk and launch of packaged milk with added nutrients have witnessed an emerging demand for carton packaging that is eco-friendly, maintains long time freshness, and increase safety during the supply chain. A surge in the demand for milk in cartons have reported during lockdown which raised concerns about the delivery of essential goods to the people. With the potential rise in the collection of milk and adoption of Ultra-High Temperature (UHT) treated extended life milk, Amul, India’s largest milk producer focuses on modernizing its aseptic processing capacity by using new generation high-speed lines of Tetra Pak. In May 2019, Amul Gujarat Cooperative Milk Marketing Federation (GCMMF), declared that it will invest nearly $86 million- $115 million to establish new milk processing plants and widening capacity of current units. This, in turn, will further accelerate the demand for milk carton packaging in the country.

Global Liquid Packaging Cartons Market Share by Application, 2019 (%)

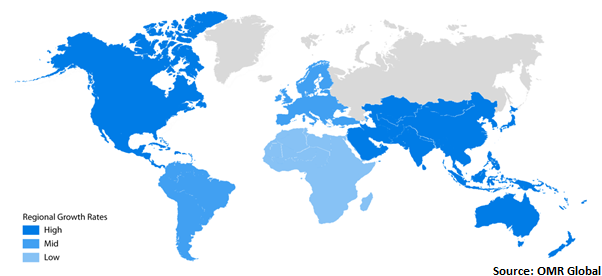

Regional Outlook

Geographically, Asia-Pacific is estimated to witness potential growth during the forecast period. Significant dairy production and increasing food and beverage industry are some key factors driving the demand for carton packaging in the region. India has the world's largest dairy industry in terms of milk production. In 2018, India produced nearly 146.31 million tons of milk, 50% over the US. Indian dairy sector has shown considerable development over the last decades. The country’s export of dairy products was 1,13,721.70 million tons to the world, valued $345.71 million during the period, 2018-19. Cartons are extensively used packaging for fresh liquid fluids, including yoghurt, milk, and other dairy products. Cartons packaging is becoming popular in beverage suppliers owing to lower transportation costs. Additionally, cartons are safer and lighter to use compared to glass, which makes it convenient for consumers.

Global Liquid Packaging Cartons Market Growth, by Region 2020-2026

Market Players Outlook

Key players in the market include Tetra Laval International S.A., Reynolds Group Holdings Ltd., SIG Combibloc Group Ltd., Smurfit Kappa Group, and Nippon Paper Industries Co., Ltd. Product launches, mergers and acquisitions, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in October 2019, SIG launched its unique combistyle carton pack to address consumers’ increasing changing needs. The pack features a uniquely shaped corner to ensure on-shelf differentiation and provides added functionality, instant consumer appeal, and more convenience.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global liquid packaging cartons market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Tetra Laval International S.A.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Reynolds Group Holdings Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. SIG Combibloc Group Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Smurfit Kappa Group

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Nippon Paper Industries Co., Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Liquid Packaging Cartons Market by Carton Type

5.1.1. Brick Cartons

5.1.2. Tetrahedron Cartons

5.1.3. Gable Top Cartons

5.2. Global Liquid Packaging Cartons Market by Application

5.2.1. Milk

5.2.2. Juices

5.2.3. Liquid Foods

5.2.4. Energy and Soft Drinks

5.2.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Adam Pack S.A.

7.2. Atlas Packaging

7.3. BillerudKorsnäs AB

7.4. Carton Service, Inc.

7.5. CSi packaging

7.6. Dai Nippon Printing Co., Ltd.

7.7. Elopak AS

7.8. Greatview Beijing Trading Co., Ltd.

7.9. Huhtamäki Oyj

7.10. IPI Srl

7.11. Liquibox Corp.

7.12. Mondi plc

7.13. Nampak Ltd.

7.14. Nippon Paper Industries Co., Ltd.

7.15. Parksons Packaging Ltd.

7.16. Qingzhou Heli Packaging New Material Co., Ltd.

7.17. Refresco Group

7.18. Reynolds Group Holdings Ltd.

7.19. SIG Combibloc Group Ltd.

7.20. Smurfit Kappa Group

7.21. Stora Enso Oyj

7.22. Tetra Laval International S.A.

7.23. Tri-Wall Ltd.

7.24. WestRock Group

1. GLOBAL LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY CARTON TYPE, 2019-2026 ($ MILLION)

2. GLOBAL BRICK LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL TETRAHEDRON LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL GABLE TOP LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

6. GLOBAL LIQUID PACKAGING CARTONS FOR MILK MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL LIQUID PACKAGING CARTONS FOR JUICES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL LIQUID PACKAGING CARTONS FOR LIQUID FOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL LIQUID PACKAGING CARTONS FOR ENERGY AND SOFT DRINKS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL LIQUID PACKAGING CARTONS FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY CARTON TYPE, 2019-2026 ($ MILLION)

14. NORTH AMERICAN LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

15. EUROPEAN LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPEAN LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY CARTON TYPE, 2019-2026 ($ MILLION)

17. EUROPEAN LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY CARTON TYPE, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

21. REST OF THE WORLD LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY CARTON TYPE, 2019-2026 ($ MILLION)

22. REST OF THE WORLD LIQUID PACKAGING CARTONS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL LIQUID PACKAGING CARTONS MARKET SHARE BY CARTON TYPE, 2019 VS 2026 (%)

2. GLOBAL LIQUID PACKAGING CARTONS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL LIQUID PACKAGING CARTONS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD LIQUID PACKAGING CARTONS MARKET SIZE, 2019-2026 ($ MILLION)